When Do You Stop Paying Social Security 2024. In march, seniors can expect. Once the established social security wage base is met, you can stop withholding and paying social security tax.

The 2024 tax limit is $8,400 more than the 2023 taxable maximum of $160,200 and $61,800. So let’s say you make $350,000 a year.

For Instance, You Are Exempt From Paying Social Security Taxes If You Waive The Right To Any Related Benefits And Meet Other Conditions.

Once your earnings exceed a specific amount, you can stop paying into social security for the rest of the year.

If You're Paid Evenly Throughout The Year, You May Be Finished Paying Into Social Security Before The Midpoint Of 2024.

Some retirees will also owe state taxes on social security when they file in 2024, but the number of states that tax benefits will decline in the following year.

The Social Security Taxable Maximum Is Adjusted Each Year To Keep Up With Changes In Average Wages.

Images References :

Source: www.pfadvice.com

Source: www.pfadvice.com

What Age Do You Stop Paying Taxes on Social Security? Personal, Social security benefits collected in 2024 may be taxed at the federal and state levels. In 2024, this limit rises to $168,600, up from the 2023.

Source: www.pgpf.org

Source: www.pgpf.org

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, As long as you are at least 65 years old and your income from sources other than social security isn't high, then the tax credit for the elderly or. But if the wage base is not reached during.

Source: smartmoneymamas.com

Source: smartmoneymamas.com

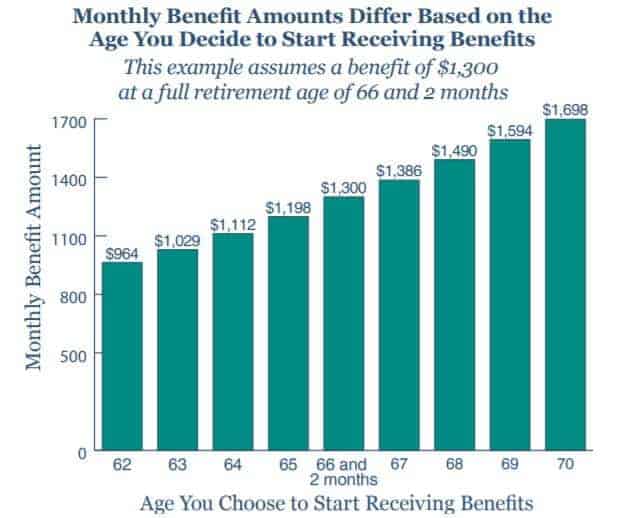

How Much Can You Expect From Social Security? Smart Money Mamas, This is in stark contrast to the average. Social security benefits collected in 2024 may be taxed at the federal and state levels.

Source: www.youtube.com

Source: www.youtube.com

Do You Have To Pay Tax On Your Social Security Benefits? YouTube, As long as you are at least 65 years old and your income from sources other than social security isn't high, then the tax credit for the elderly or. For anyone who turned 66 prior to 2024, full.

Source: cepr.net

Source: cepr.net

When Do the Rich Stop Paying into Social Security? Center for, The 2024 tax limit is $8,400 more than the 2023 taxable maximum of $160,200 and $61,800. Some retirees will also owe state taxes on social security when they file in 2024, but the number of states that tax benefits will decline in the following year.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

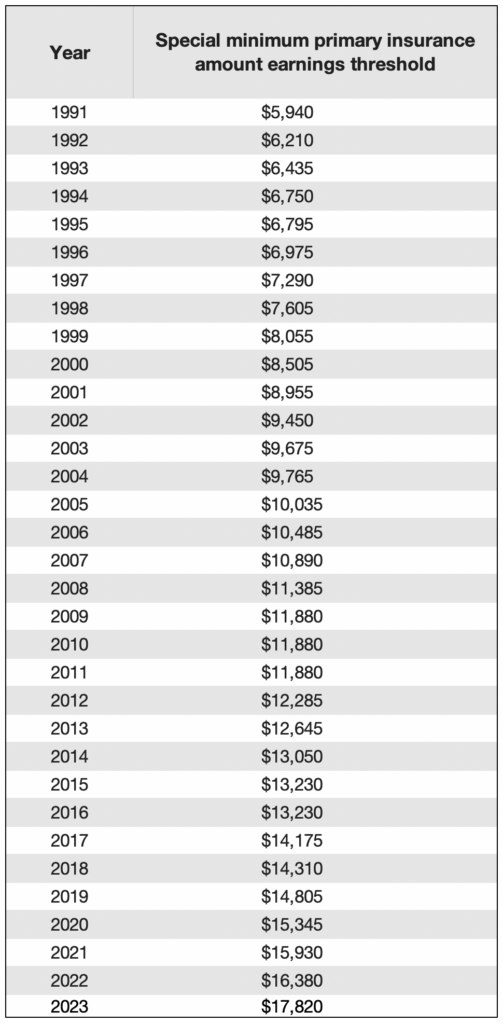

What is the Minimum Social Security Benefit? Social Security Intelligence, In 2024, this limit rises to $168,600, up from the 2023. So let's say you make $350,000 a year.

Source: directexpresshelp.com

Source: directexpresshelp.com

Schedule of Social Security Payments for January 2023 Direct Express, This is in stark contrast to the average. For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023).

Source: www.securemoneyadvisors.com

Source: www.securemoneyadvisors.com

10 Ways to Increase Your Social Security Payments, So let's say you make $350,000 a year. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Source: directexpresshelp.com

Source: directexpresshelp.com

2023 Social Security Payment Schedule Direct Express Card Help, So if you earn $168,600 or. Reporter, consumer & social trends.

Source: www.youtube.com

Source: www.youtube.com

Will I Still Have to Pay Social Security if I Work Past Retirement Age, Here are seven things social security recipients, present and future, should know about taxation of benefits. Reporter, consumer & social trends.

Will Retirees Stop Paying Tax On Social Security Next Year?

Emily brandon and rachel hartman jan.

In 2024, If You Collect Benefits Before Full Retirement Age And Continue To Work, The Social Security Administration Will Temporarily Withhold $1 In Benefits For Every.

Once the established social security wage base is met, you can stop withholding and paying social security tax.