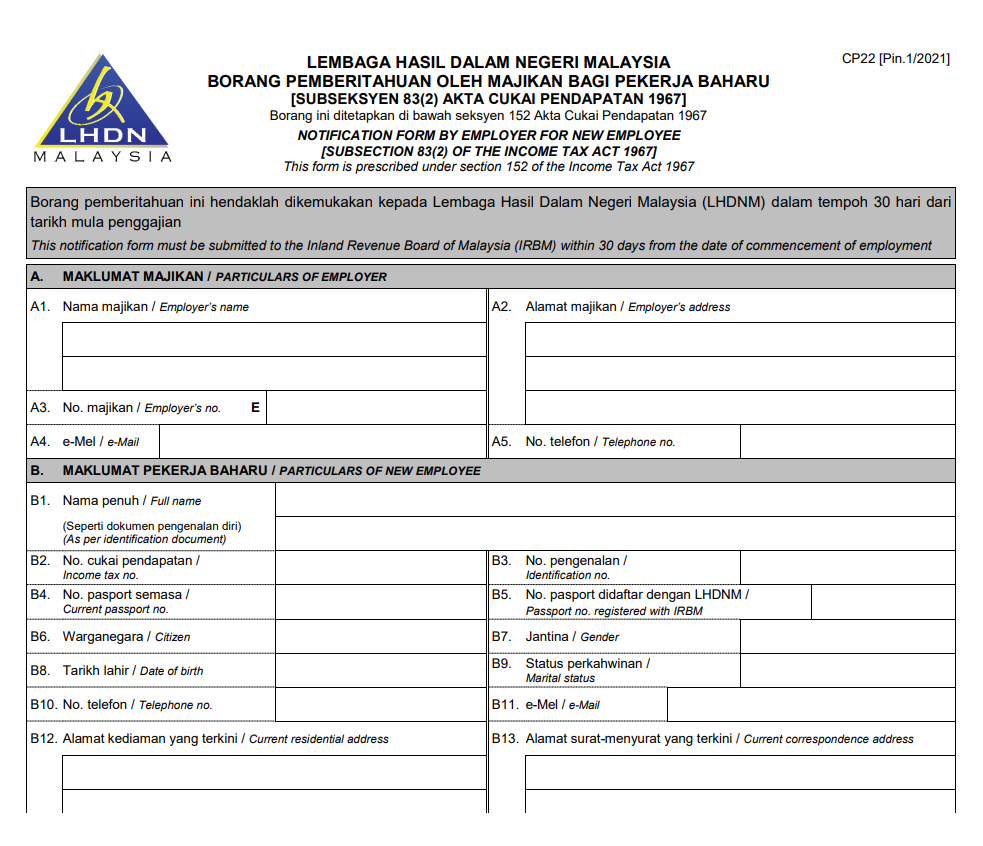

Cp22 Lhdn 1 Jan 2025. Delay or failure to submit. Cp22 is a form that all employers have to submit to lhdn to declare their newly recruited employees.

Updated over a week ago. Borang cp22 is a government form that is issued by lhdn, essentially it is a notification of new employee form.

Form Cp22 Should Be Submitted With Lhdn For Any New Employee Who Is Subject Or Likely To Be Subject To Tax Within 30 Days Of Their Join.

Last modified on february 16th, 2025.

Updated Over A Week Ago.

Starting from january 1st, 2025, it will be the responsibility of all employers to report.

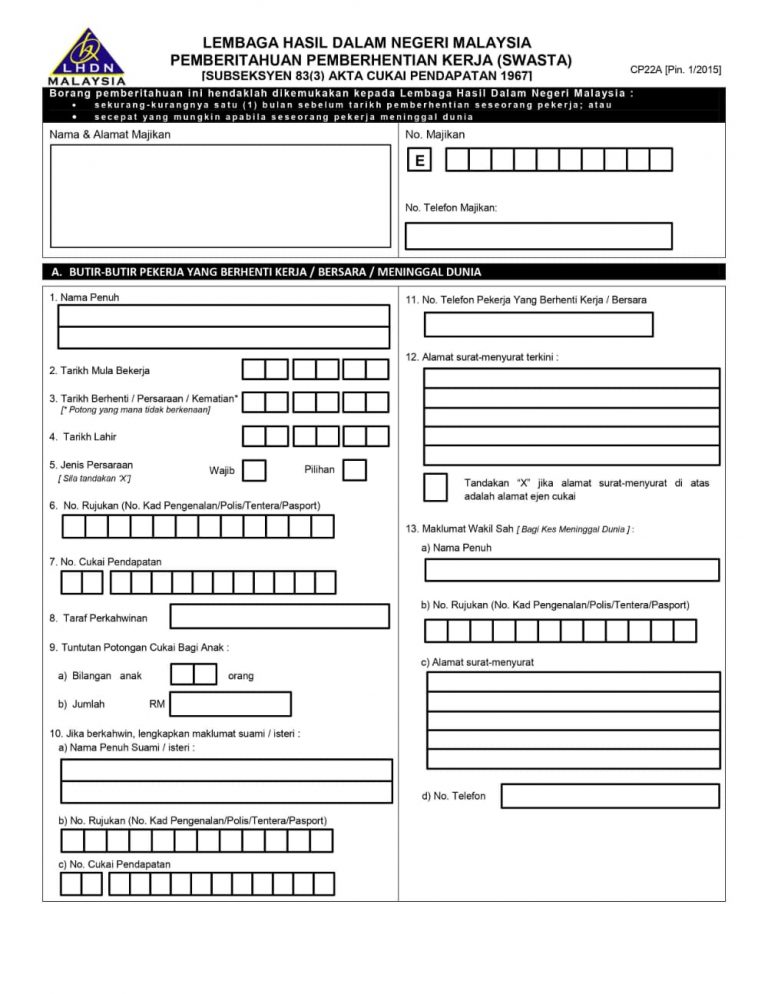

Form Cp22B (Tax Clearance Form For Cessation Of Employment Of.

Images References :

Source: www.pdffiller.com

Source: www.pdffiller.com

20212024 Form MY LHDN CP22 Fill Online, Printable, Fillable, Blank, Form cp22 should be submitted with lhdn for any new employee who is subject or likely to be subject to tax within 30 days of their join. Irbm's form cp22 is the notification of new employee form.

Source: blog.kakitangan.com

Source: blog.kakitangan.com

Changes in New Year 2022 Inland Revenue Board / LHDN, However, the employer is not required to furnish. Last modified on february 16th, 2025 cp22a must be submitted with lhdn when an employee is leaving your company.

Source: ecentral.my

Source: ecentral.my

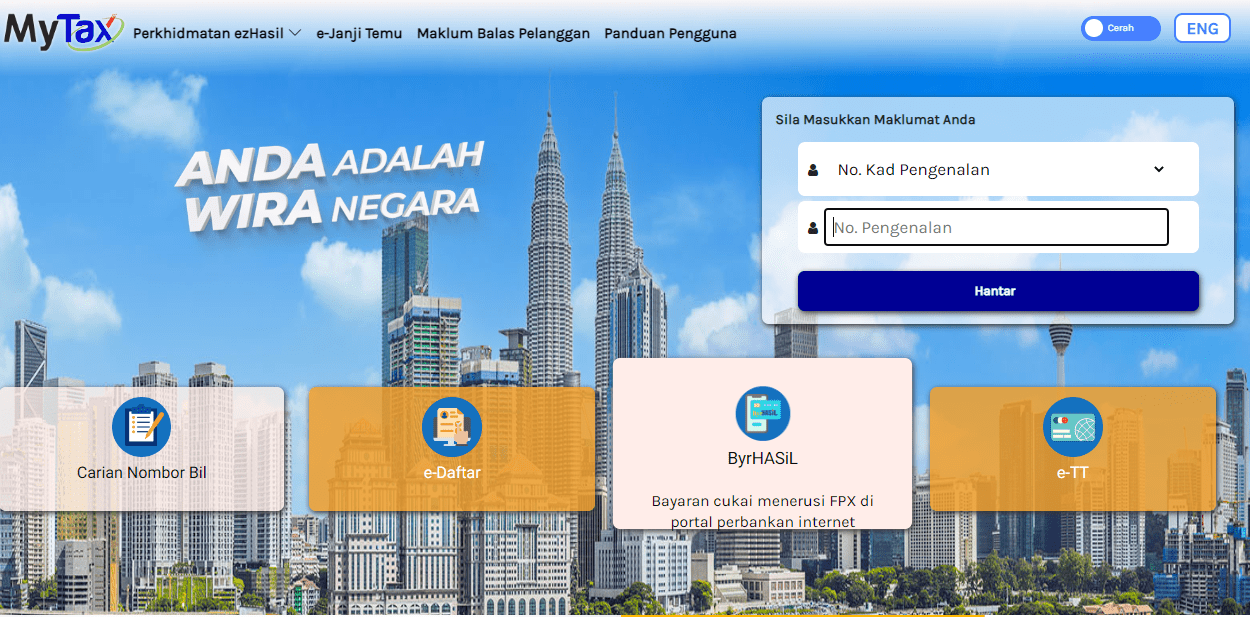

Cara Daftar Cukai LHDN Untuk eFiling 2023 / 2025, Return form (rf) filing programme. Return form (rf) filing programme.

Source: www.sql.com.my

Source: www.sql.com.my

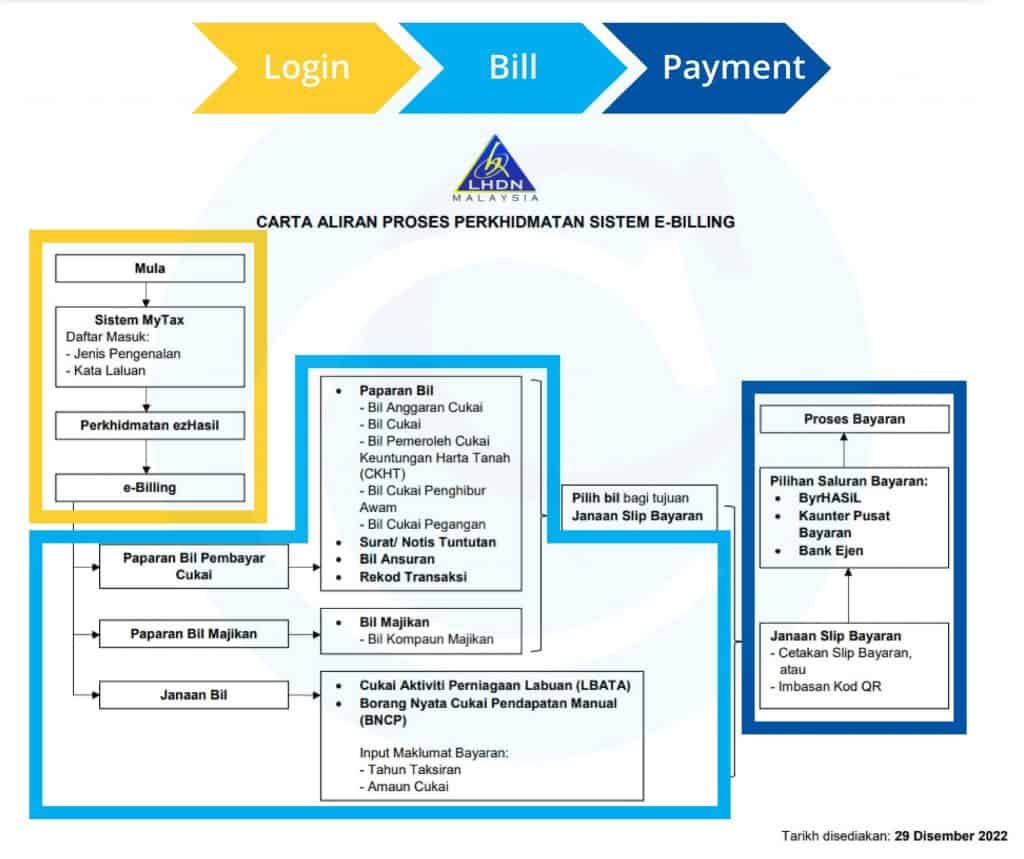

What is CP22 & CP22A Where to download CP22, CP22A? SQL Payroll, How to add employer’s representative through mytax. Cp22a on the other hand is another form submitted by.

Source: www.centralhr.my

Source: www.centralhr.my

How to Submit CP22 for New Employees via LHDN MyTax Portal CentralHR, In the 6th or / and 9th month, and / or 11th month* of the basis period (w.e.f ya 2025) submission of income tax return. The employer must notify the local irbm branch within 30 days after the new employee's starting date.

Source: ecentral.my

Source: ecentral.my

Cara Daftar Cukai LHDN Untuk eFiling 2023 / 2025, In the 6th or / and 9th month, and / or 11th month* of the basis period (w.e.f ya 2025) submission of income tax return. Last modified on february 16th, 2025 cp22a must be submitted with lhdn when an employee is leaving your company.

Source: www.hellokerja.com

Source: www.hellokerja.com

Senarai Pelepasan Cukai Pendapatan LHDN 2021 Untuk eFiling Tahun 2022, Mytax is the official online portal of the inland revenue board of malaysia (lhdnm) that allows taxpayers to manage their tax affairs conveniently and securely. Starting from january 1st, 2025, it will be the responsibility of all employers to report.

Source: fuh.my

Source: fuh.my

Cara Daftar eFiling 2023 Borang Nyata Cukai LHDN, Return form (rf) filing programme. Return form (rf) filing programme for the.

Source: www.mahdinur.com

Source: www.mahdinur.com

Wow! Panduan E Filing Lhdn 2023 Wajib Kamu Ketahui, Criteria on incomplete form cp21, cp22, cp22a and cp22b which is unacceptable; Form cp22b (tax clearance form for cessation of employment of.

Source: www.scribd.com

Source: www.scribd.com

LHDN CP22A Pin.1 2021 PDF, Delay or failure to submit. Return form (rf) filing programme for the.

Criteria On Incomplete Form Cp21, Cp22, Cp22A And Cp22B Which Is Unacceptable;

Return form (rf) filing programme for the year 2025.

Within 7 Months From The Date Following The Close.

However, the employer is not required to furnish.